Nutmeg State Financial Credit Union

500 Enterprise Drive

Rocky Hill, Connecticut

Meeting Room Location: Fourth Floor Meeting Room, Nutmeg State Financial Credit Union, 500 Enterprise Drive, Rocky Hill, Connecticut

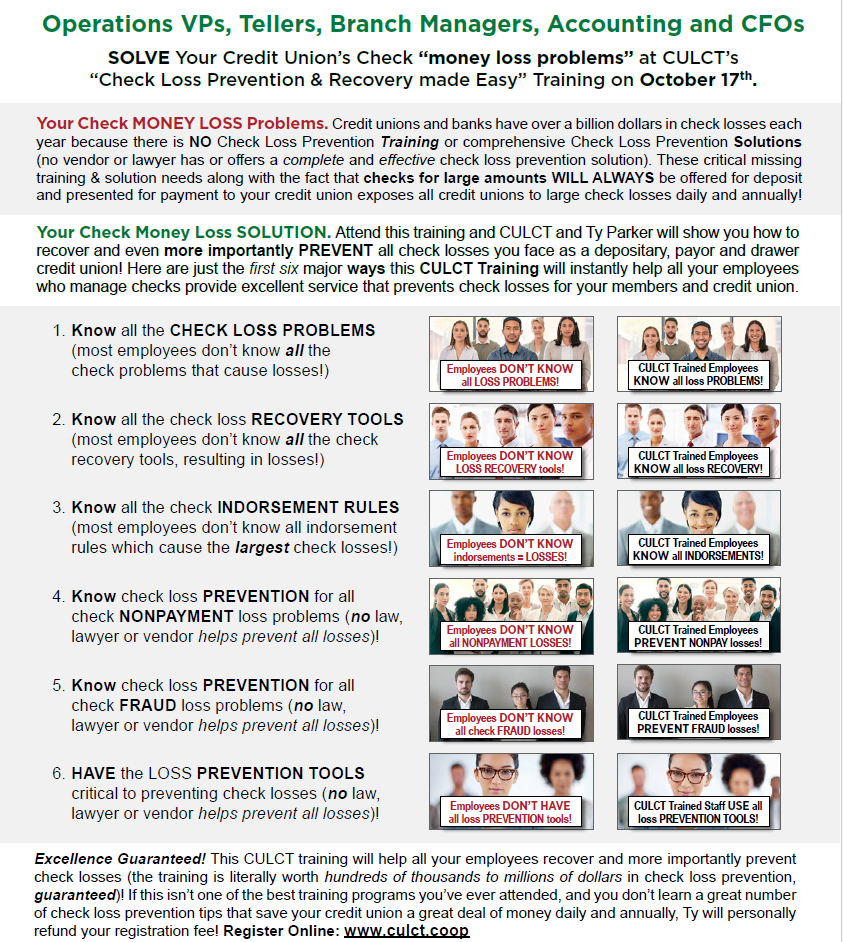

Financial institutions have over a billion dollars in check losses annually, and every credit union issues its own checks, takes checks for deposit & thus is exposed to large losses & needs to be at this program!

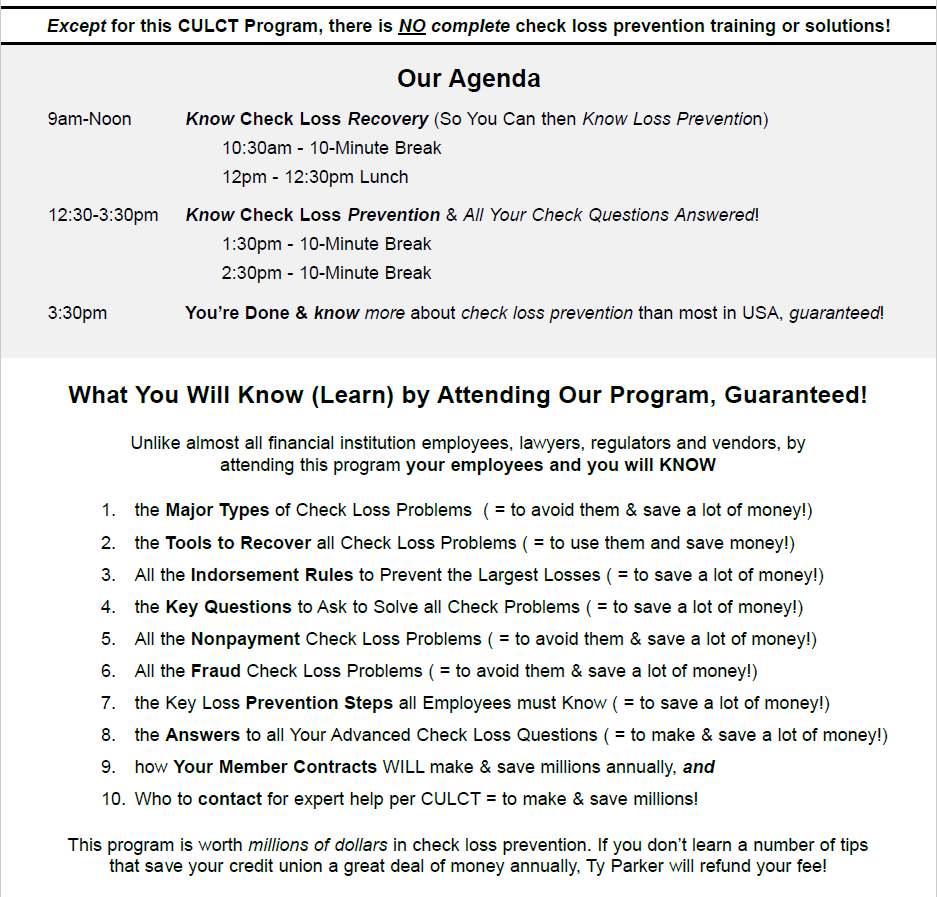

Our program will address all the key check nonpayment & fraud loss issues under state and federal law for your credit union 1. as a "payor institution" (checks that are drawn on you) and 2. as a "depositary institution" (checks that are not drawn on you that you take for deposit). More importantly we'll learn how to help your credit union prevent those check losses in both roles, as well as provide your members with excellent check loss prevention service. We'll also address the key loss prevention issues that affect your credit union's cashier's (or teller's) checks as well.

Specific issues to be discussed at this program include:

✓All major check nonpayment loss problems (NSF, Stop Pay, No Account, Stale-dated checks, etc.),

✓All major check fraud loss problems (checks with alterations and forged signatures),

✓Why Regulation CC DOESN'T prevent losses & how to prevent losses on checks offered for deposit,

✓Critical insights on overdraft/courtesy pay services that prevent millions in litigation losses.

✓All stop payment, non-received and lost and stolen issues for checks,

✓Truly understanding the consequences of the late return rule for your credit union (in all its roles),

✓Shifting check nonpayment and fraud losses to member-drawers after final payment,

✓All the latest remote deposit capture issues (both the good news and the bad news),

✓A number of advanced nonpayment and fraud loss issues that all credit unions must know,

✓The key rights tellers (& thus all employees) must know (& have in contracts) to prevent check losses,

✓And much much more!

Bring yourself and all your questions about checks to this program and we'll answer them for you!

This program will provide you with a number of multimillion dollar check loss prevention ideas to take back to your credit union and implement immediately, guaranteed!

Who Should Attend this Program?

This program is of great value to any employee who helps members (in person, online or by phone) with check issues, and/or whose work includes dealing with members' checks and related problems including:

- Operations Managers

- Every Branch Manager

- Training Professionals

- Member Service Representatives/FSRs

- Accounting and Auditing

- Collections & Risk

- All Call Center/Service Center Employees

- Compliance Officers

- Every Teller

- All Senior CU Management (checks are never going away)

CU Registration

League member credit unions can register for this training. Lunch is included.